2025 will be a big year for eCommerce. Consumer expectations will continue to evolve around more flexible delivery options during pre- and post-purchase stages. Macroeconomic shifts are also happening more frequently and with greater magnitude, so retailers and logistics services providers (LSPs) still face persistent supply chain challenges.

Because of its complexity, the last mile is a key proving ground for revenue, logistic efficiency, and customer loyalty. Last mile operations highlight whether retailers and LSPs invested in the right technology to balance their supply chain and cost challenges with customer satisfaction strategies (which are often at odds).

Bringg uncovered details of how well retailers and LSPs are performing in the last mile. The State of the Last Mile: Challenges, Insights, and Implications surfaces survey results from 500 director-level professionals in the U.S. and U.K. The leaders shared the last-mile challenges, wins, and investments they experienced in 2024 as well as what their strategies are for 2025.

The key findings were clear: Continuous last-mile improvement isn’t a differentiator, it’s an imperative.

- The last-mile directly impacts cart conversion, customer loyalty, and customer lifetime value.

- Despite being the hardest last mile element, 82% of enterprise retailers plan to invest in more 3PLs.

- Retailers are investing in solutions like last-mile orchestration, AI automation, same-day delivery to stay competitive and cost effective in 2025.

The full report has over 20 pages of statistics and insights. Some of the biggest findings are summarized below but be sure to explore the full report to see much more.

The last mile impacts customer loyalty

Last-mile deliveries are a crucial step in the supply chain because of how closely they’re tied to the overall shopping experience: 65% of consumers will abandon a retailer after two to three late deliveries. Unfulfilled delivery promises and missed expectations quickly erode customer trust and lead to lost sales.

Survey respondents agreed. In fact, 75% stated that the delivery experience directly impacts:

- Cart conversion

- Customer loyalty

- Lifetime value

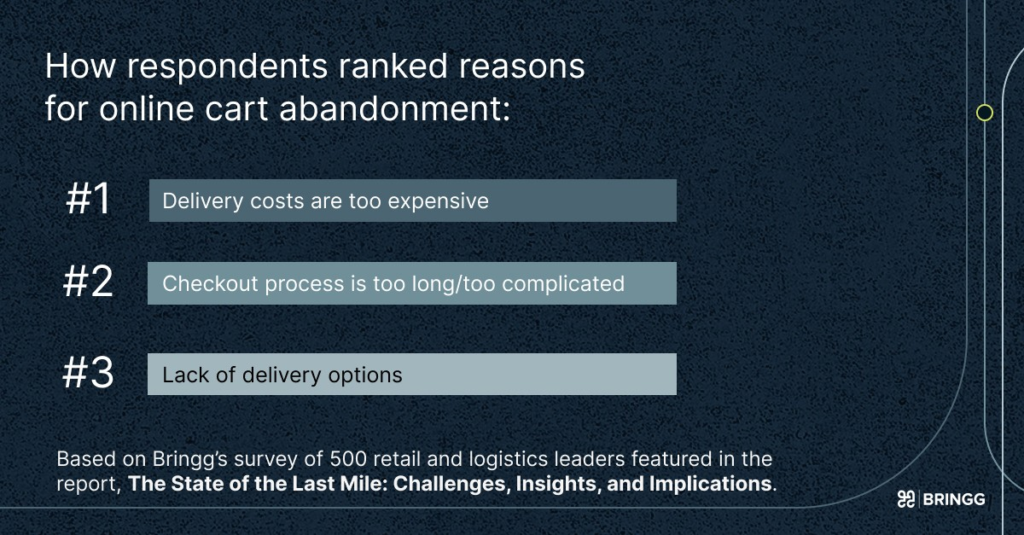

This was also demonstrated through online cart abandonment. Three of the biggest causes for failed checkouts are delivery-related:

- Delivery costs are too expensive

- Checkout process is too long or complicated

- Lack of delivery options

Retailers also said the number one reason they lost customers was because their competitors offered more delivery options.

The costs and benefits of 3PLs

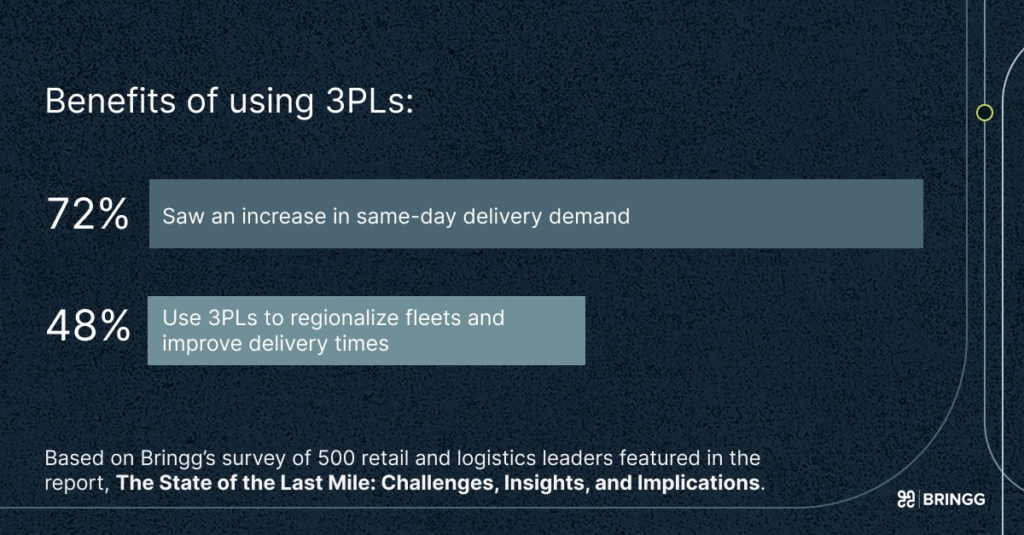

Working with 3PLs unlocks greater operational efficiency for many businesses but the wins come at a cost.

The number one last-mile challenge across respondents was “working with multiple carriers.” Why? There’s less control and it’s difficult to “maintain consistent customer experiences” across multiple operators.

And yet, two-thirds of retailers use 3PLs for more than 50% of all their deliveries. More specifically, 82% of enterprise retailers said their 3PL investments will either stay the same or increase in 2025. There’s good reason for the increased investment: 48% of businesses said 3PLs improve their delivery times.

The reality is that 3PLs are a necessary investment for business scalability. Retailers use 3PLs to regionalize fleets for faster delivery times because it’s more cost-effective than investing in their own fleets.

The biggest last-mile investments

Consumer preferences, business demands, and last mile technology continues to evolve. Businesses that want to stay competitive should grow alongside those elements—well-planned technology investments are fundamental to this evolution. However, there are often significant last-mile investment barriers to overcome for many companies:

- 40% said business requirements are hard to define

- 35% said measuring ROI is difficult

- 35% said costs are too high

New last-mile tech investments are most impactful when they’re shaped around well-defined business needs. Without a clear roadmap, new solutions add complexity rather than streamline operations.

The companies that did adopt new technology in 2024 invested most in:

- Last-mile orchestration and management tools

- Digitization tools to automate operations

- AI technology to personalize the customer experience

Major eCommerce players like Amazon and Walmart set customer expectations for more efficient and flexible delivery options—and those expectations aren’t likely to change anytime soon. So retailers are continually investing in new or expanding last-mile capabilities in 2025. For example:

- 60% will invest in same-day delivery

- 31% will invest in express delivery

- 21% will invest in curbside pickup

Effective digitization and last-mile delivery investments can increase efficiency, reduce costs, and improve customer satisfaction.

However, in order to achieve wins at the customer’s door, leaders have to ask themselves:

- How fragmented are current last-mile operations?

- What real-time insights are missing from existing visibility tools?

- How can AI and ML improve both efficiency and personalization?

- How should short-term ROI and long-term scalability be balanced?

Businesses manage a great deal during the last mile. The leaders who continue to invest in the last-mile strategies that meet the needs of their business and their customers will be the winners across this make-or-break delivery stage.

Explore the full “State of the Last Mile” report

The insights collected here are only about 50% of what’s present in Bringg’s full State of the Last Mile report. Access the full report to learn:

- The top reasons retailers lose customers

- The percent of big and bulky, grocery, and apparel retailers increasing or maintaining 3PL investments

- How to balance 3PLs investment while maintaining brand experience and efficiency

- The full list of last-mile technology investments focused on operational efficiency

- Additional metrics around the biggest barriers to technology adoption