2025 was a big year for the last mile. Retail giants like Amazon, Walmart, and IKEA made major investments in AI. Fulfillment networks got more diverse and expansive. Consumer delivery preferences also shifted away from speed toward reliability and flexibility.

Take a look at some of the biggest headlines from 2025 and what retailers should be aware of in 2026.

Key takeaways:

- Growth and resilience through diversification. Retailers expanded their last-mile networks with regional carriers, postal access, and crowdsourced fleets to reduce risk and reach more customers. Diversification became a structural advantage—not just a backup plan.

- AI evolved from optimization to infrastructure. AI moved from insight to execution, powering routing, forecasting, and fulfillment at scale. It’s now fully embedded in logistics rather than layered on top.

- Delivery experience became a loyalty lever. Speed took a back seat to reliability and flexibility with shoppers. Their preferences are evolving and they now reward brands that offer things like on-time arrival and flexible scheduling more than same-/next-day shipping.

- 2026 outlook: smart integration beats extremes. Adapting to evolving consumer demands and intentional, smart tech investments will matter more than only delivering on table stakes or blind experimentation.

Trend 1: Last-mile diversification delivers resilience and growth

In 2025, macro disruptions, from tariff shifts to fulfillment labor shortages, exposed the limits of over-optimized, centralized last-mile models. In response, retailers expanded rather than simplified their logistics networks. What emerged was a deliberate push toward diversified delivery execution: private fleets, regional carriers, crowdsourced networks, postal access, and urban micro-fulfillment all calibrated to reduce exposure to any single point of failure.

These investments supported multiple business goals: faster cycle times, greater geographic coverage, and more flexible cost structures. In an environment where 47% of consumers hold retailers accountable for failed deliveries, diversification took the lead as a service safeguard and reputational hedge.

The biggest headlines in last-mile diversification

Amazon invests $4 billion in rural last-mile network to unlock new growth and reduce dependency

Amazon’s $4 billion rural expansion was one of the clearest examples of last-mile diversification in 2025, with major investments in new facilities that create jobs and delivery capacity across underserved rural markets. Since 2019, Amazon reported that rural delivery speed improved by 65%, and average delivery times dropped by more than two days in those regions. Expanding further into rural areas, including Missouri, Arkansas, Idaho, Mississippi, and upstate New York, reflects a broader strategic goal: meet demand everywhere.

Amazon Now offers 30-minute delivery using urban micro-fulfillment

But, Amazon didn’t only invest in geographic reach, it also doubled down on urban density. In late 2025, the company piloted 30-minute delivery for groceries and household essentials in select neighborhoods throughout Seattle and Philadelphia. The pilot uses specialized micro-fulfillment centers, strategically located near population centers, that boosts packing efficiency and reduces travel time. The service also starts at $3.99/delivery for Prime members, demonstrating free delivery has a limit.

Amazon re-engages FedEx to stabilize big and bulky delivery capacity

Amazon had a third significant last-mile move in 2025: it quietly signed a multi-year deal with FedEx to handle residential, big and bulky deliveries. The partnership follows UPS’s move to cut Amazon volumes by more than 50% later this year. FedEx will support Amazon’s Extra Large (AMXL) delivery network, handling fulfillment and installation of furniture, appliances, and other big-and-bulky products. The diversification strategy aims to stabilize delivery operations, control costs, and preserve customer experience, especially for products that typically carry higher financial and reputational risk.

USPS opens its last-mile network to external bidders

In a move to reshape last-mile delivery economics, USPS announced in December 2025 that it will open access to its national delivery network through a formal bid process. Shippers of all sizes can tap into more than 18,000 delivery units (DDUs) and give retailers and carriers a new option to diversify fulfillment routes, reduce dependency on major integrators, and optimize downstream costs. Bidders can propose their own volume, pricing, and timing models for delivery, with flexibility around same- or next-day drop-offs. The solicitation process is expected to formally begin in early 2026, with phased implementation to follow in Q3.

Target reconfigures stores into fulfillment hubs to scale next-day delivery

Target accelerated its store-as-hub strategy in 2025 and expanded next-day delivery to 35 major U.S. cities by converting retail locations into micro-logistics centers. This move exemplifies how omnichannel retailers are reallocating physical assets to gain agility, reduce cost, and meet fast-shipping expectations without expanding fixed infrastructure. The company now delivers next-day to 85% of goods sold in stores, with most orders eligible for free shipping with no minimum for Target Circle 360 members. This strategy reduced backroom processing and cut fulfillment time per unit, improving cost and operational efficiency.

Key details:

- Target’s store-as-hub model uses 11 sortation centers, each fed by 30–40 local stores, enabling faster last-mile dispatch using Shipt or third-party carriers.

- Target’s routing and forecasting tech improvements now allow same-day order placement as late as 6 p.m. for next-day delivery in many markets.

- In pilot cities like Chicago, fulfillment was concentrated in fewer, higher-volume stores, enabling faster rollout and flexibility based on regional demand.

- This strategy helped Target respond to “high-growth” zip codes and localize inventory allocation, while turning off shipping from low-performing stores.

Crowdsourcing continues as Uber expands into discretionary retail with Pacsun, Camping World, and Lush

In 2025, retailers including Pacsun, Camping World, and Lush launched on-demand delivery via Uber, Uber Eats, and Postmates. This marks a broader shift toward crowdsourced, platform-based delivery partnerships, allowing retailers to scale local fulfillment on-demand without owning assets or managing labor.

This effort follows similar launches:

- Family Dollar partnered with DoorDash across 7,000 stores.

- Dollar General tapped Uber Eats for same-day delivery from 14,000 locations.

- Old Navy partnered with DoorDash for seasonal same-day fulfillment.

- Best Buy teamed with Uber Eats to deliver electronics and appliances from 800+ stores.

- Home Depot uses both Uber Eats and DoorDash, following earlier efforts with Instacart to offer same-day bulky item delivery nationwide.

These examples highlight a fragmented but growing reliance on gig delivery infrastructure to solve last-mile delivery challenges, particularly during high-volume periods.

Trend #1 takeaway: diversification now powers the last-mile

In 2025, retailers leveled up their models with diversified delivery networks built for flexibility, redundancy, and responsiveness. Private fleets, regional carriers, micro-fulfillment, and crowdsourced platforms are now structural components of a resilient logistics stack. This diversification distributes risk, expands reach, and allows brands to scale intelligently in uncertain markets.

Trend 2: AI evolved execution across logistics workflows

In 2025, AI stopped sitting on the sidelines. Major retailers like Walmart, Amazon, and IKEA moved past AI-powered dashboards to executing core logistics functions like optimizing routes, fixing inventory gaps, and scaling fulfillment in real time. The result: faster decisions, leaner operations, and more resilient supply chains.

The biggest last-mile AI headlines

Ikea meets rising customer expectations with in-house last-mile tech

As consumer demands grow and fulfillment complexity intensifies, IKEA made significant last-mile AI investments to boost delivery speed, efficiency, and visibility. In October 2025, the retailer acquired Locus, a U.S.-based, AI-powered logistics platform to bring key delivery capabilities like advanced route optimization, real-time tracking, and enhanced vehicle utilization in-house.

The investment marks a major shift from third-party reliance to technology-led control, and supports IKEA’s $2.2B omnichannel investment strategy, which includes new store formats and expanded fulfillment infrastructure through 2026.

Amazon speeds up delivery, improves accuracy, and scales robotics use with AI

Amazon made last-mile delivery faster, smarter, and more precise with three AI-powered innovations in 2025.

- Wellspring helps delivery drivers navigate complex urban environments. It improves delivery location accuracy, maps over 2.8 million apartment addresses, and identifies parking and access points at 14,000+ complexes across 4 million address with uses generative AI

- Amazon’s AI-powered demand forecasting engine predicts when and where products are needed, factoring in regional events like holidays and weather patterns, which has already led to:

- A 10% improvement in long-term demand forecasting for deals

- A 20% improvement in forecasting for popular items

- Faster deliveries and reduced carbon footprint across the U.S., Mexico, Canada, and Brazil

- Agentic AI allows robots to understand and act on natural language instructions, moving robotics beyond automation into autonomous, decision-making tools that assist in high-density logistics hubs.

Walmart scales AI for demand forecasting and real-time logistics risk mitigation

Walmart continued its investment in agentic AI and neural networks to strengthen visibility, forecasting, and fulfillment efficiency across its global supply chain. The goal: improve inventory accuracy, reduce delays, and future-proof operations against market volatility. It uses an in-house system to forecast demand at multiple future points—factoring in historical data, local trends, and planned events to increase inventory accuracy across its network.

Improved forecasting allows Walmart to reduce excess stock, plan replenishment schedules earlier, and limit the need for inventory to sit idle in warehouses. AI-led forecasting also extends to import operations, helping the retailer manage shipping timing and quality by predicting fluctuations in international demand and supply chain flow. AI models also help Walmart identify diversified port strategies and optimal shipment locations during disruptions like Panama Canal congestion or severe weather.

Walmart diversifies operations across borders with an AI-driven supply chain model

Walmart also extended its AI-powered fulfillment blueprint to international markets in 2025 with a unified tech stack across Mexico, Costa Rica, Canada. The company built a globally adaptive supply chain that reduces waste, boosts speed, and diversifies fulfillment at scale using agentic AI tools, predictive inventory systems, and self-healing logistics. Walmart’s shift from static supply networks to adaptive, AI-enabled ecosystems makes its last-mile operations capable of reacting to local conditions without losing global consistency. The initiative has already saved $55M.

Walgreens boost prescriptions resilience and cuts costs after revived automated micro-fulfillment

In a move that combines AI investment with diversified operations, Walgreens restarted its automated micro-fulfillment centers (MFC) investment last year. The move signals a renewed focus on decentralized, robotics-enabled fulfillment, particularly for prescriptions, to improve service levels, reduce labor dependency, and expand coverage while keeping costs in check. The network of now 12 MFCs handles 40% of total prescriptions volume, processing 3.5 million prescriptions weekly and driving a 24% YoY increase in shipped volumes, helping reduce store-level labor strain.

Outcome: AI matured from tool to infrastructure

Delivery AI is no longer an optimization layer—it’s becoming the architecture behind modern logistics. In 2025, leading retailers stopped treating AI as a standalone solution and started embedding it into core workflows: inventory planning, order routing, fleet coordination, demand shaping, and fulfillment execution.

This shift unlocked compounding benefits. AI improved accuracy or reduced costs but it also shortened feedback loops, automated recovery, and turned fragmented systems into responsive networks. For businesses operating in volatile, margin-sensitive environments, AI is now operational infrastructure rather than optional innovation.

Trend 3: Speed still matters to shoppers, but so does reliability and flexibility

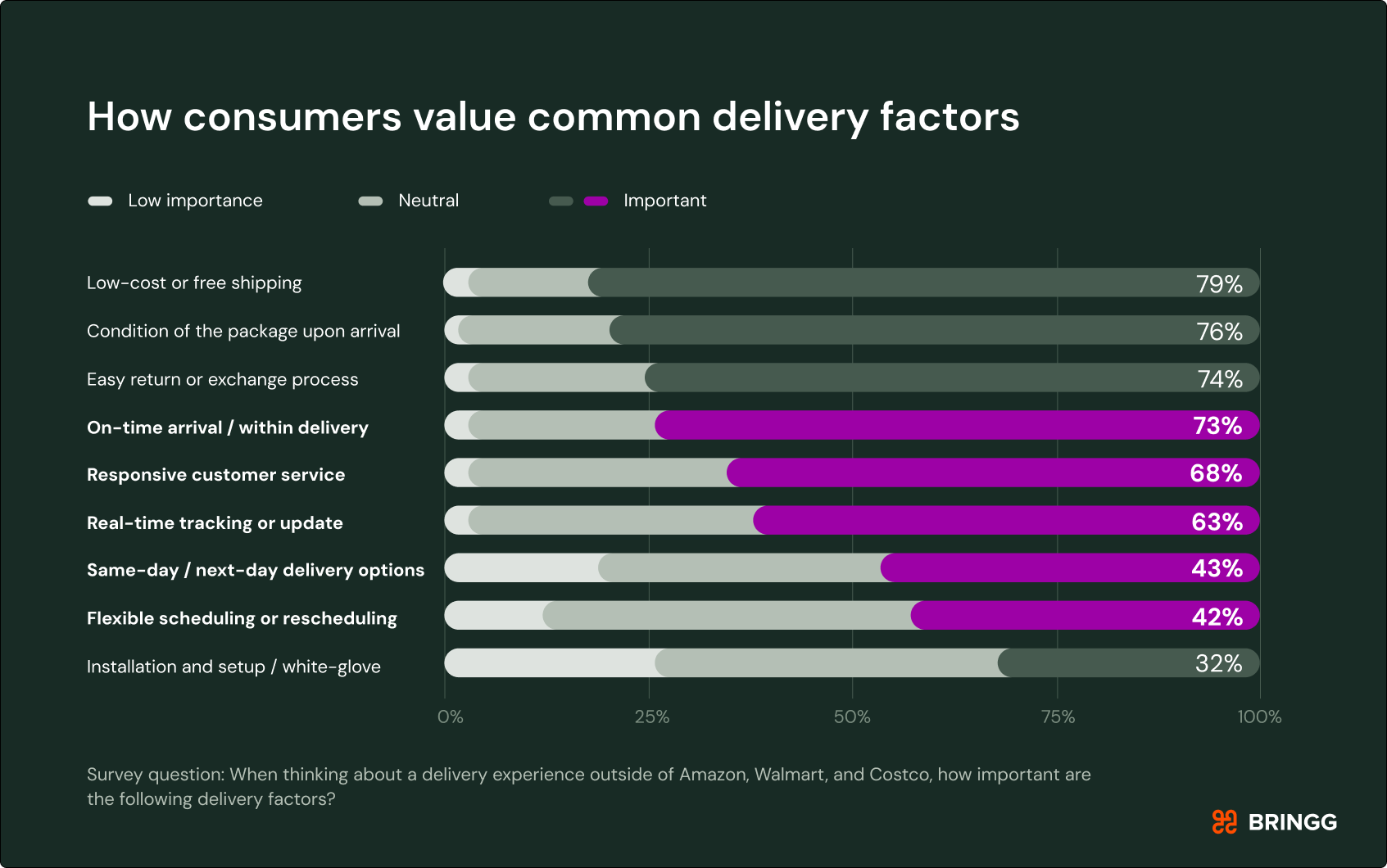

In 2025, consumer delivery expectations evolved beyond just free shipping and fast delivery. Now, delivery decisions increasingly reflect reliability, visibility, and choice over mere convenience.

More than 70% of consumers think about delivery before they even reach checkout, and 61% will abandon their cart if a retailer doesn’t offer real-time tracking or delivery updates. Another 51% of consumers will abandon their eCommerce carts if there isn’t a clear on-time arrival window.

Meanwhile, the operational burden of ultra-fast shipping continues to mount. AP News reported that the race to “fastest possible delivery” comes with rising labor, fuel, and fulfillment costs, which makes it a margin killer for many brands (hence Amazon Now charging for expedited, 30-minute delivery). Only 29% of consumers value same-/next-day delivery enough to abandon their shopping cart for it, which further reinforces delivery speed is most effective when paired with reliability and customer control, not as just a standalone differentiator.

Notable consumer insights:

- 73% of shoppers say on-time arrival is core to a great delivery experience, even more important than low-cost shipping or returns.

- 65% of consumers say a great delivery experience makes them return to a retailer, even if it costs more than competitors.

- 61% of consumers abandon carts when delivery isn’t flexible.

- 54% of shoppers would abandon a retailer permanently due to unresolved delivery issues or poor post-purchase support.

- Late deliveries are the #1 cause of a negative delivery experience—more than damaged items or wrong products—and 35% would abandon a retailer permanently because of it.

Clearly consumer sentiment is shifting, with new insights being published throughout the year. Most notably, DHL found that 81% of consumers will abandon a purchase if their preferred delivery option is unavailable. Meanwhile, Ryder research shows that 53% of consumers rarely or never make purchases strictly based on same-day delivery and nearly ⅓ of respondents say scheduled delivery is more important than fast shipping.

Outcome: delivery became a loyalty lever, not just a race to the finish line

In 2025, the most effective delivery strategies weren’t the fastest, they were the most reliable, visible, and customer-aligned. Retailers that clearly communicated delivery options, honored time windows, and enabled flexible fulfillment earned repeat business.

2026 outlook: adapt to new expectations and don’t rush AI

Reliability and flexibility separate leaders from the pack

In 2026, consumers will continue to expect fast shipping but they’ll no longer reward it as a differentiator. Speed, free returns, and package condition are low stakes. What defines preference and loyalty now is how well retailers deliver on the promise: on time, with transparency, and with options that reflect real-life schedules.

In a market where 61% of shoppers abandon carts when delivery isn’t flexible, and 73% say on-time arrival matters more than low-cost shipping or returns, the retailers that treat reliability and flexibility as operational priorities, not cost centers, will win loyalty. Good experiences like these are enough to make 65% of shoppers buy from a retailer again, even if the price is higher than a competitor’s.

To stay competitive in 2026, last-mile leaders will:

- Build more accurate and visible delivery promises earlier in the buying journey

- Offer scheduled delivery windows and real-time updates, not just tracking links

- Design frictionless, not just free, return processes

- Develop networks and tech stacks that support dynamic rescheduling, order changes, and partial deliveries

- Measure delivery success not by speed alone, but by first-attempt accuracy and resolution rates

Delivery is now a key part of a brand’s reputation. Retailers that align last-mile delivery with consumer expectations around flexibility, control, and consistency will earn trust, more customer lifetime value, and future success.

Pragmatic agentic AI investment

While the pace of consumer-driven agentic AI adoption is still uncertain, McKinsey reports that it is accelerating and companies should prepare for a future where AI agents, at least in part, drive commerce on behalf of consumers. Given last-mile complexities, companies will always need a human-in-the-loop. But if they’re too reliant on legacy systems that require intensive human decision-making, they could fall behind competitors that automate repeatable tasks across their operations.

Retailers may also eventually need to develop their own AI agents or adapt their systems to support agent-mediated customer journeys. Brock Johns, director analyst with Gartner Supply Chain said more companies are interested in investing in agentic AI and advanced functionality like forecasting and modeling. Gartner also predicts that half of all cross-functional supply chain management (SCM) solutions will utilize AI agents by 2030.

However, retailers should take things slow first.

“Most agentic AI projects right now are early stage experiments or proof of concepts that are mostly driven by hype and are often misapplied,” said Anushree Verma, Gartner senior director analyst. “This can blind organizations to the real cost and complexity of deploying AI agents at scale, stalling projects from moving into production. They need to cut through the hype to make careful, strategic decisions about where and how they apply this emerging technology.”

In fact, Gartner predicts that over 40% of agentic AI projects will be canceled by the end of 2027 because of high costs, unclear business value, or poor risk controls.

This combination points to a pragmatic 2026 stance: Agentic concepts may influence roadmaps, pilots, and vendor evaluations, but most organizations will likely prioritize proven improvements in integration, automation, and delivery experience before scaling agent-led execution broadly.

Conclusion

2025 was a big year for eCommerce delivery and momentum isn’t slowing down. This year, retail leaders will implement new technologies and operational changes that support new, and ever-evolving, consumer behavior. One thing is clear: delivery experience is king, and 2026’s winners will shape the last-mile around it.